Argentum et aurum comparenda sunt

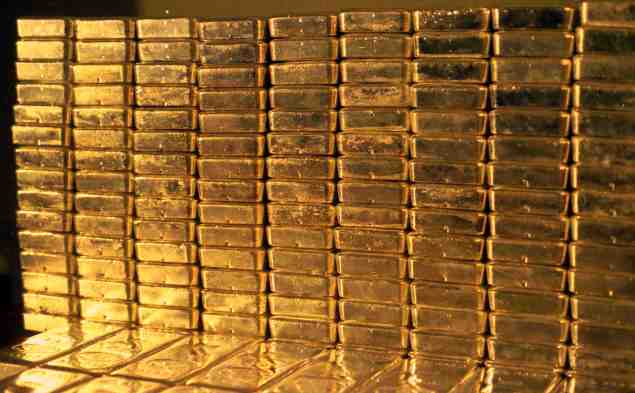

Do not be fooled by the picture

The above bars look like gold but are in fact silver bars. When I took the picture back in 1974/75 my photos came out with silver looking like gold. Today I believe that silver will be a better investment than gold for the next decade-plus.

Considering that the Danish tabloid press called me “The Silver King” I should like to make a few comments about silver, on which I was an expert. Although, I 47 years ago told most of my favourite clients to buy palladium first and foremost. Thereafter, I did believe in silver and thereafter platinum and rhodium. I had considerable difficulties convincing our client to buy palladium at USDollars 41-43 an ounce, now trading at over US Dollar 2300 an ounce. The whole concept of the “silver king” was a tabloid creation, although, I could have been a true silver king, if the Danish Special Prosecution (Bagmandspolitiet) did not follow the instruction of the prime minister and close my companies and bring fear into the Danish investment population.

I have been saying now for decades, that ultimately, we all have to face reality and the music. Someone has to pay for all the printing of money and debts – One day.

This morning (February 2021) I received an email today:

The Chairman of the Fed knows this. The President knows it. So does the Treasury Secretary. In fact, nearly everyone at the top levels of the U.S. Government knows it, too. But they would never say it out loud. Not even to themselves. If they did, the whole house of cards would come tumbling down.

What’s their dirty little secret? The national debt is now too big to be paid off! That’s right, the U.S. A.’s national debt of $28 trillion dollars — $157 trillion if you count the bills we have to pay in the future — is now too big to be repaid by raising taxes or cutting spending.

There’s only one way out of this fiscal crisis, and they’re not going to tell you about it for obvious reasons.

This time it is worse than when I wrote in our market report back in 1976, that the meetings of the IMF were discussing “built” another penthouse on top of another one on the 50th floor of their skyscraper, no one wanted to speak about the fact that the skyscraper was built in a swamp and slowly sinking. Now we have reached the end of all cycles.

As a technical analyst and market technician, I have close to sixty years followed a foundation incorporated in my birth year, the Foundation for the Study of Cycles was incorporated on January 10, 1941, by Edward R. Dewey after he discovered coincidental cycles in nature and business. I read his compelling paper, The Case for Cycles published in 1967 when Dewey presents years of research that convinced him of natural environmental forces that stimulate and depress mankind in mass. This leads me to go to meetings in London City with like-minded people looking at technical analysis of the prices, being bonds, equities and commodities and the first steps to founding STA (The Society of Technical Analysts).

I made an academic paper, in the late 1960s, on the moon’s influence on the price of cotton and silver over a period of 170 years, at the time, clearly showing the connection with the monthly cycle of the moon. After all, we have known for years that women’s menstrual period was governed by the moon cycle. Mental and hormonal states are under the influence of the Moon. Just as the Moon takes about 28 days to circle around Earth, a woman’s menstrual cycle is approximately 28 days.

My Sixty Years of Experience

Have taught me that nothing lasts forever, changes will always come. I started out in adult life as a “financial advisor” nearly 60 years ago; at the time, I was a very young man taking my knowledge from others and indeed from reading many books. After working several years with investment research, including creating the first offshore investment fund report for institutional investors (a technical and quantitative analysis of mutual funds and investment trusts), I 1969 co-founded the first company in Europe, possibly in the world, for financial and estate planning in London for High-Net-Worth Investors (HNWI), Associated Financial Planning (AFP). Sadly, I lacked the tenacity to stay the course, mostly totally distracted from the basic investment advice I had for years given to others.

When I created Scandinavian Capital Exchange in Scandinavia in 1973, I pioneered alternative investment and investment in commodities, including precious metals. I had been an advocate of gold since 1968, when it was normal in Swiss banks to have 10% of a clients money in gold. Many of my clients made 5-6 times profit, after Nixon’s actions.

Because of well-known events, I did not even consider continuing to work in finance. Central to the relationship in banking and finance is trust. When such trust has become an issue, it can never be restored. This meant I stayed away from this area of work; nevertheless, I did follow the markets from the sideline.

I happened to be in New York on Monday the 19th of October 1987, the Black Monday; I later witnessed near 35 years of history of financial markets. We will now face monumental changes, not only caused by the world pandemic but more due to the printing press of money and a change of cycles.

We are coming into new major cycles, both for wars, inflation and commodity prices. Energy is the greatest inflation hedge, so oil and gas will move, possibly dramatically. Everyone should have gold, silver and palladium in the portfolio, but also industrial metals like copper and nickel will go up. As to equities, the military industry will benefit from major crises and uncertainties. The massive build-up of debt will ultimately lead to bankruptcies of nations. Anyone invested in bonds will lose their shirt. We all have to pay the price for our leaders’ reckless spending schemes, obscene debts and money printing. Without being dramatic, we will witness the collapse of the societies, currencies and investment markets that have been built on those follies. This will happen very soon!!

more to follow…..

The IPO of Coinbase, to me, indicate the top of this market (April 14, 2021)

Somehow, I do not believe in all these cryptocurrencies now; when Coinbase, the Digital Currency Exchange, is worth more than BP, this is unrealistic, moreover, commands a higher value than the major stock exchanges in the world together. This is unrealistic and naïve to think that this bubble will not burst. It is the Emperor without clothes, with more than 7000 cryptocurrencies!! Bitcoin trading north of $63,000!!

It is interesting that Coinbase acts as principal and not as an exchange; they can create their own crypto assets, and moreover pass on any bad deals to their customers. They first made a profit last year, how convenient, after nine years of trading.

Does anyone out there with any sense?

Coinbase is somewhat different from other well-known cryptocurrency exchanges as they are more of a broker than an exchange. This means that when you buy cryptocurrencies on the platform, you are actually purchasing the coins directly from Coinbase, as opposed to trading them with other users.

In return for this, Coinbase charges you to deposit and withdraw funds, as well as a transaction/trading fee every time you buy or sell coins.

Don’t forget you only have the option of going long at Coinbase. This means that you can’t make a profit if you think the markets will go down.

Every Tom, Dick and Harry can create their cryptocurrency; there are now more than 13.500 cryptocurrencies. Most of them have no assets to back their valuation. Worse, no income. They are only making money for their founders and early investors. What realism is there with more than $2 trillion in crypto? All air!!!!!

As FT writes: Sceptics note that cryptocurrencies have yet to achieve widespread adoption in payments and other core areas of the financial system. Jay Powell, chair of the Federal Reserve, on Wednesday called cryptocurrencies “vehicles for speculation”, reflecting a view that is still prevalent among policymakers around the world. In 2018, Bank for International Settlements head Agustín Carstens said “cryptocurrencies are, in a nutshell, a bubble, a Ponzi scheme and an environmental disaster”.

Others warn that prices are only sustained by speculative buyers.

Andrew Bailey, the governor of the Bank of England said last week that investors risked losing all of their money. “They have no intrinsic value. That doesn’t mean to say people don’t put a value on them, because they can have extrinsic value. But they have no intrinsic value,” he said. “I’m going to say this very bluntly again. Buy them only if you’re prepared to lose all your money.”

What will happen if there are future crypto wars? Cyberattack on electricity network? Knocking out all the exchanges? Or that one country like the USA forbids cryptocurrencies? Turkey has just banned digital money payment for goods and services, who is next? China does not allow citizen to own or trade in cryptocurrencies. What will happen when the government request all banks to reject crypto and inform on owners with crypto accounts to the Revenue? Nearly all the exchanges, act as principals, charging interest on the huge leverage trading; they can monitor all the trading and force price moves, creating more fees and profits – what kind of exchange is that?

I was the co-founder in the late 1960s and early 1970s of a group of Technical Analysts in London, holding regular meetings. Later we incorporated in the late 1980s and became the Society of Technical Analysts (STA), today a highly respected professional association, and leading member of the international Market Technician Association.

I should have predicted all this speculation coming. Moreover, looking at the charts of bitcoin, it appears one of the easiest things to trade and make money in during the last ten years, with regular and very identifiable cycles. 320, 80 and 20 days. I have for years just walked away from something which is so obvious, – I have been blind. For me it is not an issue if all these now 12.000 plus cryptocurrencies is a total fraud, we now have values of more than 2.5 trillion dollars, and despite most of this being just “air” with NOTHING behind., one could have had a fantastic ride both on the up and downside.

Bitcoin lies in the same economic category as financial games like poker, roulette, and the lottery. These are all zero-sum games. The property binding all zero-sum games together is that the amount of resources contributed to the pot is precisely equal to the amount that is paid out. Because nothing additional is created in a zero-sum game, for every player who wins something from the pot, there must be a loser.

Compare this to win-win financial opportunities like stocks or bonds. In the case of a stock, each shareholder’s contribution is used to support the underlying firm’s deployment of capital. This cocktail of machinery, labour, and intellectual property are combined to create products, the sale of which generates a return. Put differently, as long as the firm’s managers deploy the money in the pot wisely; the firm can throw off more cash to shareholders than the sum originally put into the pot.

PS! I have to declare that my opinion might be tainted by the fact that I back in 2011, agreed to receive 280 Bitcoins, as a refund for some software I had purchased with a credit card. The bitcoin was valued at 9-10 cents, it was only reluctantly I agreed, but the developer told me that they had to pay credit card fees and I on my end and it would be better to get bitcoin. I received an electronic wallet for the first time. I did notice that during 2012, the value of the bitcoin went up, but I did not have the possibility to engage myself in the trading, as I found the whole concept conspicuous, obviously not knowing much about the whole concept. Nevertheless, I place my wallet in a TrueCrypt encryption, which even later complicated everything more.

In 2016-17 I tried to get into these hard drives; however, I failed, with the computer, I believe, having the wallet with the bitcoins. So until now, I have lost 280 bitcoins, having them virtually in my hand in 2011 – at that time with some reluctance.

A good read: The Tether Ponzi Scheme – Single Lunch, reflection on what it is all about and indeed how stupid “investors” are – all the time, never learn from history. Shows how to steal USD 60 billion and not go to prison, a lot smarter than Bernard Madoff. It is worth reading Amy Castor investigation and timeline.

What sixty years plus experience in the financial markets have taught me, reality ultimate comes to everyone. Some have to face the music, with losses, bankruptcies and personal misery and suffering, blaming everyone else. I am still totally convinced this is the greatest Ponzi scheme in history!!!

In the latest update, the crypto market is being constantly manipulated, providing great trading opportunities, however since I wrote above and to now 26 July, more than four months ago, nearly all prices have been crashing.

Today, the FT had an interview with the head of Man Group, Luke Ellis, who said: “If you look at cryptocurrencies as a whole, it is a pure trading instrument. There is no inherent worth in it whatsoever. It is a tulip bulb,” Ellis said, referring to the flower that became the focus of a 17th-century Dutch financial mania. London-based Man Group, which manages $127bn for clients, is known for using quantitative models that seek to profit from pricing anomalies and trends in the markets. Much of the market action, in crypto trading, involves participants who doubt their ultimate utility.

“Crypto is essentially an economic cult that taps into very base human instincts of fear, greed and tribalism, combined with economic illiteracy as a means to recruit greater fools to pile money into what looks like a weird, novel digital variant of a pyramid scheme,” argues Stephen Diehl, a crypto-sceptic software engineer. “Although, it’s all very strange because it’s truly difficult to see where the self-aware scams, true believers and performance art begin and end. Crypto is a bizarre synthesis of all three.”

Given the global financial system’s growing exposure to digital currencies, the culture around crypto, how much or little it changes, could have major consequences for retail investors, central banks and the environment. Crypto’s most ardent proponents predict it will eradicate inequality, wipe out corruption and create untold wealth. Most cults make similarly expansive promises. And as the gulf between promise and reality grows, things get dark.

Be realistic, what will happen to crypto” currencies” when either limited or total war breaks out when paper/fiat money can’t even be used. Only gold and other real valuables can buy something. With no internet connection, even no electricity, where is your electronic wallet? In any conflict, knocking out communication is the first objective, therefore, in any conflict around the world, the internet is the first to go down. Take a hard look at the reality.

Just forget all this, do not, compare bitcoin to gold or any real asset; bitcoin is only an insane illusion of speculators’ hope, fuelled by the many who purchased this dream at 10 cents, not $69,000. With all these “few” people’s billions, they can suck in all the fools, they can daily manipulate the markets and operate their own “exchanges” for their total benefit, allowing all the fools out there to make stops and sell orders, always taken out, both on the long and short side of the market, making more money for these people. To me, the whole thing is not only the wild west but total criminality and daylight robbery. As of writing near 10,000 cryptos!!!

Most recently, SEC chair Gary Gensler described cryptocurrencies as a “wild west” and added that they were “full of fraud, fraud and abuse.”’

Although, I have only been an observer, I predicted the collapse of the crypto “currencies, more than 14 months ago. Anyone reading this page last April (2021) could see I predicted that this completely mad hysteria of Bitcoin and crypto with DeFi, was just in reality a one BIG PONZI – a fraud. Sadly, few will be prosecuted and even go to jail.

Never, in my right mind, would I have believed that it was possible to deceive and defraud the world with such a great Ponzi scheme.

It reminds me, what I told the First Institutional Investors Conference in 1969 (at the Savoy Hotel in London), that the world wants to be deceived and indeed referred to another Dane, Hans Christian Andersen, fairy-tale story about an emperor without clothes as two tailors took advantage of people’s stupidity.

I never believed these crypto, latest count more than 22,000 “token”, was a currency, just ridiculous. They represented to me a simple greed and fraud, in its simplicity. Yes, there was many very smart people out there involved and some took away huge fortune.

Nevertheless, it is all the hike and disinformation, it was the emperor without clothes and the early “investors” according to research only 64 people, in Bitcoin, have been able to orchestra the whole concert, moving the market as they liked and to get all the “stupid” people in buying their story.

When every Tom Dick and Henry can “create” a coin, and simply steal money from the public, something ultimately must happen, and we see reality coming to all market including the stock market and bonds. Cash and real value will be KING, I do not see the bottom yet and the real CRASH!! Just wait when the world must account for debt!

“The tide has gone out in crypto, and we’re seeing that many of these businesses and platforms rested on shaky and unsustainable foundations,” said Lee Reiners, a former Federal Reserve official who teaches at Duke University Law School. “The music has stopped.”

If you believe, as I do, that crypto is to a large extent a Ponzi scheme, this may just happen to be the moment when the scheme has run out of new suckers.

But there’s also a more fundamental issue: People who touted cryptocurrencies as a hedge against fiat-currency inflation — sort of a digital equivalent of gold — fundamentally misunderstood how fiat currency systems work, and also, for what it’s worth, misunderstand what has historically driven the price of gold. It was, in fact, predictable that an upsurge in inflation would drive the price of Bitcoin down — although maybe not that it would produce such an epic crash.

An interesting article!!!

Beware of Scams!!!

Decentralized finance is the biggest scam in the cryptocurrency universe | by Max Mittelstaedt I Bitcoin for Governments | Medium

Decentralized finance is the biggest scam in the cryptocurrency universe, it is NOT decentralized, all the hype have just been created to make the founders billions, for little “work”.

Decentralized Finance is a lie. 99% of the Altcoins are unfortunately centralized scams.

Defi does not have a secure foundation. Defi projects belong to a company with a CEO, an address and a legal department. Most coins had an ICO (An initial coin offering (ICO) is a type of funding using cryptocurrencies.) where the money was distributed to the founders and foundation.

Silver

Watch out for manipulations at the exchanges

The silver market has always been dominated by short-sellers, most professionals hold short positions; in fact, this is not just traders in the silver market but also other commodities. Professional traders most of the time make money; this is their livelihood and business. So they will sell something they hope to buy later at lower prices since their experience tell them this has worked most of the time in the past. All my money and profitable trades I had made at the time through ten years were being on the short side, both in shares, gold and silver.

I went short in silver in late 1979 – relative big -as I knew the floor brokers were short with 7-8000 contracts, so when silver exploded, I felt OK and indeed after the 15th January 1980, I had the short-selling guaranteeing a huge profit by the decision of the US Exchanges, I as standing to make 50-100 million Dollars. what I did not know was that Bagmandspolitiet was listening to all my telephone calls, they and large investors who were long in silver wanted me out of and isolated in prison. I was on the other investment side, the opposite, to the Hunt Brothers in Texas and the Saudis – all long in silver. Who knows, I could have made not 100 million but possible 500-600 million dollars at the time. Such an opportunity in one’s life is truly rare.

Manipulation, it is when someone controls and dominates the market by means of an excessively large position. By holding such a large concentrated position, the manipulation is largely explained. In real terms, whenever a single entity or a few entities come to dominate a market, all sorts of alarms should normally be sounded.

Price manipulation is the most serious market crime possible under commodity law. In fact, there is a simple and effective and time-proven antidote to manipulation that has existed for almost a century, and that solution is speculative position limits. Currently, the Commodities Futures Trading Commission (CFTC) in the US is attempting to institute position limits in silver, but the big banks are fighting it tooth and nail.

As far as any benefits the manipulators may reap, it varies with each entity. But if you dominate and control a market by means of a large concentrated position, you can put the price wherever you desire at times, and that’s exactly what the silver manipulators do regularly. This explains why we have such wicked sell-offs in silver; the big shorts pull all sorts of dirty market tricks to send the price lower.

Recently we have seen the London Metal Exchange show who controls the market: According to Financial Times, “the 145-year-old venue scrapped trades after a price surge wrongfooted a Chinese metals tycoon. LME chief executive Matthew Chamberlain defended cancelling trades after a sharp spike in nickel prices

The London Metal Exchange has enraged some of the world’s most influential electronic traders after it shut down its nickel market and unwound thousands of deals in response to a spike in the price of the metal.

Months after the 145-year-old exchange upset its traditional users by considering an end to raucous in-person dealing, the LME this week shut down its nickel trading — a market where it sets global benchmarks — in a move last seen in the tin in 1985.

The crisis measure came after the metal’s value more than doubled in two days, to a record above $100,000 a tonne, as a large bet against the nickel price left the tycoon behind Tsingshan Holding Group, China’s leading stainless steel group, facing billions of dollars in potential losses.

But the exchange also cancelled all 5,000 nickel trades that had been executed on Tuesday, worth nearly $4bn. Mark Thompson, the vice-chair of Tungsten West and a longstanding trader on the LME, estimated the exchange had wiped out $1.3bn of profit and loss on the deals. It was “in the interests of the market as a whole”, the LME said.”

These exchanges will always look after their traders and cover-up or total cancel orders. This was in March 2022 and the same was the case in 1980s.

Under U.S. commodity law, the names of individual traders are kept confidential. However, it is no secret that commercial traders are the big shorts. It is also no secret that these big commercial shorts are mostly money centre banks and financial institutions. Based on government data and correspondence, the largest such short almost certainly is JPMorgan Chase & Co.

Together, the eighth largest commercial silver shorts on the COMEX generally account for more than 50% of the entire net COMEX silver market, with JPMorgan alone holding around 25% or more of the entire market. Such large holding does constitute manipulation and there is no comparable concentration on the long side; only on the short side of silver.

The current mechanism they use to suddenly rig the price lower is High-Frequency Trading (HFT). This is the placing of sell orders in great quantities by computer programs that suddenly appear as legitimate orders, but are really mostly “spoofs,” or orders entered and cancelled immediately (in the fraction of a second). When the sell orders first appear, they spook others into selling as they give the appearance of great selling about to hit the market. Instead, it is all a bluff, intended only to scare others into selling, as the vast majority of these original sell orders are never executed, nor were they ever intended to be executed. They were designed for one purpose only – to scare others into selling.

Through HFT, the commercials are able to push prices suddenly lower on very little actual volume. But once prices are put lower, the outside selling (from those who are frightened by the drop in prices) hits the market. It is that outside selling from technical traders that the commercials then buy. In a nutshell that’s the HFT scam in silver.

It is important to grasp the fact that the actual selling (and commercial buying) takes place after the price drops. Most people think great selling is what causes the price to decline, but that’s not true. The great selling only comes in after the price has been put lower, which is the purpose behind HFT in silver.

There are two distinct forces exerting artificial control of the price of silver. One is the concentration on the short side of the COMEX. The other is the ascension of the mindless and destructive computer trading of HFT.

The difference in HFT is how the regulators react to it. When it occurred in the stock market, the regulators, the SEC and CFTC, rushed to make sure such meltdowns didn’t recur in the stock market.

Instead, the HFT practitioners were given free rein to disrupt the silver market many times. All the big sell-offs in silver are related to HFT to aid those holding large short positions.

The simple and undeniable fact is that the commercials are always big buyers whenever gold and silver sell off sharply. These commercials trick others into selling after prices have been deliberately pushed lower. Because the commercials are always the big buyers on every big sell-off, that proves they are rigging the price, as it is not possible for them to always be the buyers on these pre-arranged sell-offs.

There is so much more paper silver traded than physical silver

The trading in paper silver is nearly 150 times more than the amount of mined silver. Investors who hold physical silver don’t buy and sell often; they hold. Only paper silver holders, because they only put up a fraction of the full value as margin, can be regularly tricked into selling their paper contracts on price declines. The big commercial shorts know this and that’s what the game is all about – taking paper long traders to the cleaners.

Also, there is more paper traded than real silver because there is a very limited amount of real silver and an infinite supply of paper silver. It’s important to know the difference and that difference is what makes physical silver superior to any paper alternative.

Conclusion

There is manipulation in effect in silver, but that manipulation must be viewed cold and hard. The manipulation has caused silver to be priced much cheaper than it would be otherwise, even back to the sixties when this manipulation was caused by the US Government. That makes silver a better buy. The silver manipulation also will end one day, as all manipulations throughout history have ended. Given the nature of these things, the price of silver will be much higher when the manipulation ends. This offers investors a great opportunity. Firstly, a cheap price to buy at than would otherwise be the case and, secondly, a much higher price to sell at once the manipulation is ended.

My last advice, the best approach is to put cash on the table and pay in full for whatever silver you buy; no borrowing or margin. This enables you to stay with it for the long term and ride out the inevitable price volatility. Think long-term, the long play is the best play.

Finally, if I have the opportunity, I will add to these comments about silver from time to time.

Can Physical Silver Change Your Life?

As the world heads towards an inevitable economic crisis resulting from an ever rapidly global debt bubble, speculation abounds within elements of the investor community that ownership of physical silver will have the ability, in the midst of the crisis, to change people’s lives potentially on the scale of the 2011 – 2017 price explosion of Bitcoin.

Such is the optimism among some silver investors that price forecasts ranging from $US 40 per ounce to over $US 1000 per ounce are now publicly discussed openly on the internet which is well in excess of its current price of approximately $US 13.50 per ounce.

Interesting analysis by John Adams 16 April 2020: The Undeniable Manipulation of the Silver Market

Investors are betting on a rally in silver

Latest 6 May 2020 (Taken from Financial Times and Theconervativeinvestordaily.com)

Investors are betting on a rally in silver after the gap between gold and industrial metal soared to its widest level in more than three centuries.

In March (2020) the price of an ounce of gold was 125 times higher than the same amount of silver — a record going back to at least 1687, according to data compiled by Ross Norman, a veteran gold trader.

But since then the gap has closed to about 113 times, and analysts say more gains for silver are possible, as economies start to recover from the shock of coronavirus-related lockdowns and demand returns for use of the metal in electronics and solar panels.

“The longer gold keeps having a good performance you will get speculators . . . who will go ‘oh silver is really cheap’,” said Grant Beasley, a fund manager at Highbury Capital in Toronto. “It’s not the most complicated argument but it’s true. As the speculative fever increases retail investors will go crazy. And then when they’re feverish you’re close to the top.”

Silver prices dropped to an 11-year low of $11.62 a troy ounce in mid-March, but the metal has since rebounded to trade at $15 as holdings of silver-backed exchange-traded funds hit a record high this month of 675m ounces.

Analysts at Bank of America predict silver could rise to $20 over the next 12 months as economic growth rebounds. In the wake of the 2008 global financial crisis, silver rallied 440 per cent from its bottom to $48.44 a troy ounce in 2011.

Gold has risen by 11 per cent this year to about $1,690 a troy ounce, driven by investor demand for the traditional haven asset. Holdings in gold-backed exchange-traded funds rose seven-fold in the first quarter to a record high of 3,185 tonnes in March, according to the World Gold Council.

The recent rally in the yellow metal was a sign of “deep anxiety about the global financial system”, said Mr Norman. In Alexander, the Great’s time the silver/gold ratio was about 12 to 1 and an inscription from the Karnak temple in ancient Egypt reports it as 13.3 to 1.

“Gold’s safe-haven status is coming to the fore,” he said. “Normally you’d expect silver to come along for the ride.”

About half of silver demand comes from the industrial sector, including the car and solar power industry, which has made it more vulnerable to the economic effects of coronavirus. Solar power projects are being delayed while the electronics supply chain has been hit by weaker consumer demand.

Analysts at Metals Focus predict that industrial demand for silver will drop by 7 per cent this year, with declines across all industries.

That is unlikely to be offset by shutdowns of silver mines in Mexico, Peru and Argentina, leaving a surplus of 14.7m ounces this year, they forecast.

Suki Cooper, an analyst at Standard Chartered, said silver tended to need solid demand from both investors and industries to outperform. That may not happen until later this year, she said.

Still, for many investors silver is too cheap, even given the Covid-19 slowdown. Ian Williams, chairman of the Charteris Treasury Portfolio Managers fund, said silver was just as good as gold as a hedge against inflation.

“You can go back 3,000 years before Christ — silver has never been this cheap relative to gold,” he said. “There’s no justifiable reason.”

Silver miners offer more upside to a rising price than gold miners, according to Mr Beasley. Many miners needed a price of just $17 to break even, he said. “When silver really starts to take off, the . . . returns in silver versus a gold producer are two to three times,” he said.

Among the biggest gainers in the sector so far are First Majestic Silver, a Toronto-listed miner whose shares rose by 29 per cent last month, roughly double the rise in the Canadian benchmark.

Last week Canadian mining billionaire Eric Sprott made his biggest personal investment in silver, buying a C$60m ($42m) stake in Toronto-listed explorer MAG Silver.

Enthusiasts note that the metal is used in clean-energy technologies that are set to see growing demand such as electric cars and solar panels. It is also used in 5G mobile infrastructure and in radars for autonomous vehicles.

New usages are emerging too: in March Samsung announced a new lithium-ion battery that uses a thin layer of silver-carbon material rather than graphite on its anode.

“Because silver has such a wide range of applications when one slows there’s potential for another to pick up,” said Philip Newman, an analyst at Metals Focus. “The range of applications argues for a very strong future.”

For people who have an interest in the above, I recommend following these websites:

The Silver Institute ( http://www.silverinstitute.org/site/)

The Silver Institute is a nonprofit international association that draws its membership from across the breadth of the silver industry. This includes leading silver mining houses, refiners, bullion suppliers, manufacturers of silver products and wholesalers of silver investment products. Established in 1971, the Institute serves as the industry’s voice in increasing public understanding of the many uses and values of silver.

Silver Wheaton (http://www.silverwheaton.com/)

Established in 2004, Silver Wheaton has quickly positioned itself as the largest metals streaming company in the world. The company currently has fourteen silver purchase agreements and two precious metals agreements where, in exchange for an upfront payment, it has the right to purchase all or a portion of the silver production, at a low fixed cost, from high-quality mines located in politically stable regions.

Based upon its current agreements, forecast 2012 attributable production is approximately 27 million silver equivalent ounces, including 16,500 ounces of gold. By 2016, annual attributable production is anticipated to increase significantly to approximately 43 million silver equivalent ounces, including 35,000 ounces of gold. Beyond the initial upfront payment, no ongoing capital expenditures are required to generate this growth and Silver Wheaton does not hedge its silver production.

Silver Wheaton’s industry-leading growth profile is driven by a portfolio of world-class assets, including silver streams on Goldcorp’s Peñasquito mine in Mexico and Barrick’s Pascua-Lama project straddling the border of Chile and Argentina. The company’s unique business model creates significant shareholder value by providing leverage to increases in the silver price while reducing the downside risks faced by traditional mining companies. Silver Wheaton has an experienced management team with a strong track record of success and is well-positioned for further growth.

I should like to finish with a poem about silver:

Slowly, silently, now the moon

Walks the night in her silver shoon;

That way, and that, she peers and sees

Silver fruits upon silver trees;

One by one the casement catch

Her beams beneath the silvery thatch;

Couched in his kennel, like a log,

With paws of silver sleeps the dog;

From their shadowy cote, the white breasts peep

Of doves in a silver-feathered sleep;

A harvest mouse goes scampering by,

With silver claws and silver eyes;

And moveless fish in the water gleam,

By silver reeds in a silver stream.